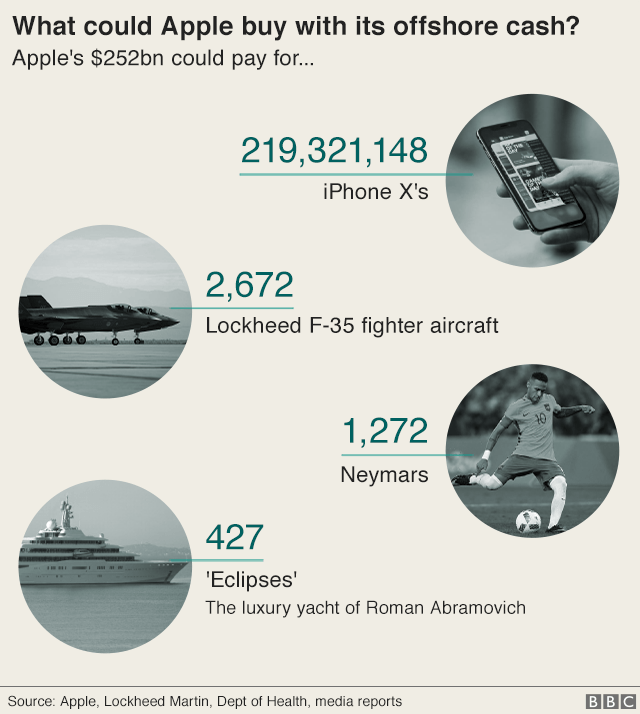

The world's most profitable firm has a secretive new structure that would enable it to continue avoiding billions in taxes, the Paradise Papers show.They reveal how Apple sidestepped a 2013 crackdown on its controversial Irish tax practices by actively shopping around for a tax haven.It then moved the firm holding most of its untaxed offshore cash, now $252bn, to the Channel Island of Jersey.Up until 2014, the tech company had been exploiting a loophole in tax laws in the US and the Republic of Ireland known as the "double Irish".This allowed Apple to funnel all its sales outside of the Americas - currently about 55% of its revenue - through Irish subsidiaries that were effectively stateless for taxation purposes, and so incurred hardly any tax.Instead of paying Irish corporation tax of 12.5%, or the US rate of 35%, Apple's avoidance structure helped it reduce its tax rate on profits outside of the US to the extent that its foreign tax payments rarely amounted to more than 5% of its foreign profits, and in some years dipped below 2%.The European Commission calculated the rate of tax for one of Apple's Irish companies for one year had been just 0.005%.

No comments:

Post a Comment